Wealth Management

Our integrated offering combines detailed financial planning, thoughtful investment management and opportunities to engage with community.

For clients with $2-20 million under management

Financial Planning

Cash Flow Analysis

Savings & Spending Goals

Tax Planning

Employee Comp & Benefits

Estate Planning

Insurance Review

Education Planning

Charitable & Political Strategy

Investment Management

Custom Designed Portfolio

ESG Investing

Shareholder Engagement

Impact Investments

Community Lending

Cash Management

Portfolio Rebalancing

Tax-Aware Investing

Learning & Engagement

Community & Peer Gatherings

Interactive Events

Volunteer Opportunities

Support for Social Enterprises

Educational Seminars

Family Office Services

Advanced Tax & Estate Planning

Collaboration with Other Advisors

Custom Impact Portfolio

Family Governance

Formation of Mission Statement

Coordination of Banking & Lending

For clients with $20+ million

Your financial planning journey

INTRODUCTIONS

A brief chat to get to you know and learn about what prompted our meeting. We’ll answer your questions and discuss our services. If we decide to work together, we’ll have the following meetings at a pace that fits your schedule.

DISCOVERY

Explore your values around money and discuss your aspirations, goals and priorities. This is also a time to develop a statement of intent around the purpose of your wealth and to identify pragmatic considerations like cash needs and risk appetite.

WORKSHOP

Collaboratively build the framework for your financial plan and collect the data we need for providing expert advice. We make sure to understand your full financial picture before offering specific recommendations.

PLAN ENGAGEMENT

A dynamic analysis and refinement of your plan based on our understanding of your unique circumstances and needs. We’ll review various plan scenarios and recommend an investment approach that is designed to achieve your goals in alignment with your values and statement of purpose.

INITIAL IMPLEMENTATION

This time is allocated to addressing areas of priority in order of urgency and relevance. Don’t have an estate plan? We might focus on that first. Have people that depend on you but no life insurance? That may be the best place to start.

ONGOING MEETINGS

We meet with our clients as often as required after the first year. The schedule and topics covered are based on your unique situation.

Investing with purpose

At Humanize Wealth, we are committed to meeting you where you are and creating a portfolio tailored to your specific circumstances. We excel at designing and implementing values-aligned portfolios that include a customized mix of stocks, bonds, community investment notes and privately owned impact investment strategies. So whether you seek market rate returns across a portfolio attuned to your goals and values or prefer a higher impact portfolio that balances financial results against the change you wish to see in the world, we can deliver a purpose-built solution that is right for you.

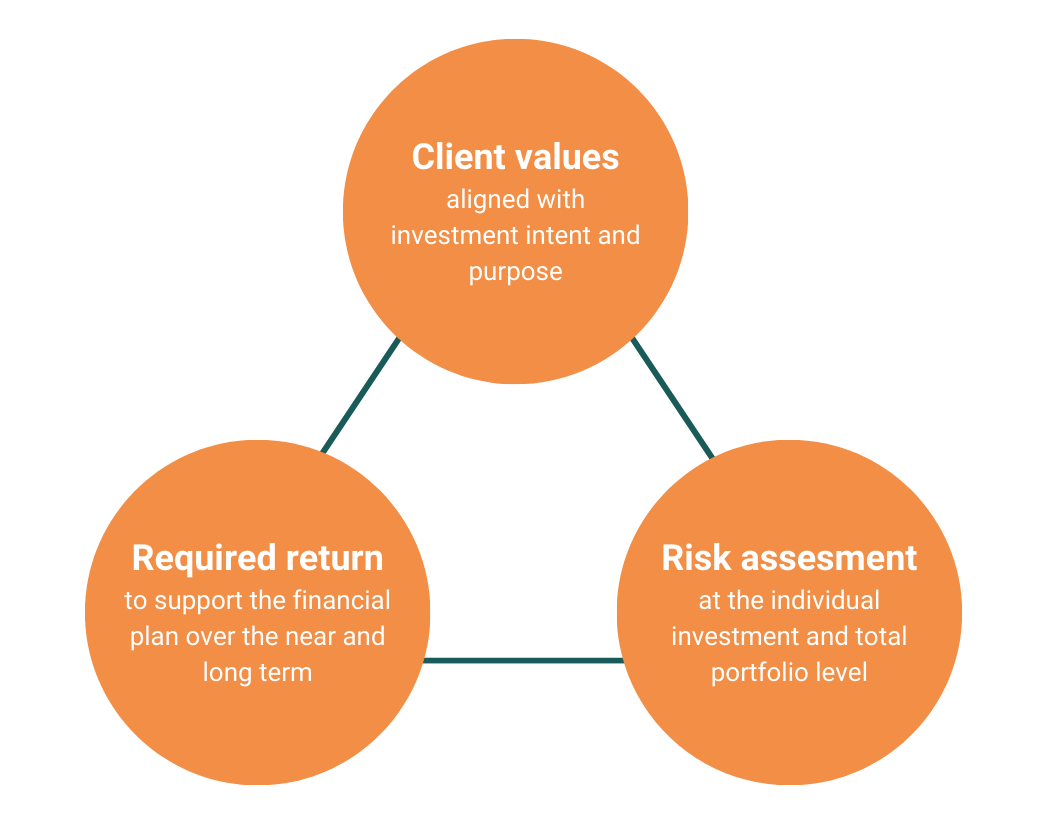

Three foundational elements shape how each portfolio is constructed

If you're passionate about using your wealth to drive better corporate practices, help dismantle systems of racism or fund global climate solutions — we are here to help. Humanize Wealth has the experience, skills and resources to support you in pursuing meaningful outcomes every step of the way.

-

We use an “open architecture” approach to access a broad range of investment types, structures and impact themes. For many clients, a diversified portfolio of stocks, bonds, funds and community investment notes managed under an ESG mandate best fits their needs. This approach is often preferred by clients who desire market rate returns alongside positive change driven by proxy voting and shareholder engagement.

Other clients who strive to achieve more intentional and targeted impact work with us to augment their portfolio with a range of private, thematic impact investments. This includes “finance first” opportunities designed to achieve market rate returns alongside positive non-financial impacts, and “impact first” strategies that intentionally seek below market rate returns in an effort to achieve greater social impact.

As signatories of the Due Diligence 2.0 Commitment, we have pledged to follow the stated principles and practices for every investment opportunity and decision to help ensure we proactively source and appropriately evaluate strategies and funds managed by and for Black Indigenous and People of Color.

Portfolios built for a range of impact

Fees

Humanize Wealth is a “fee only” advisor and a fiduciary. This means we have a duty to make all financial recommendations and decisions in the best interest of our clients rather than for our own benefit. We charge our clients a fee based on the total dollar amount of their investable assets under our care. Unlike brokers or other types of advisors, we do not earn commissions or other fees based on investment recommendations or securities transactions.

-

Due to the breadth and depth of our tailored service offering, we typically work with clients who own $2M+ in investment portfolio assets. We may work with clients below this amount depending on specific circumstances. We do not charge separate fees for financial planning and the wide variety of related wealth management and administrative services that may be performed on your behalf.

Our fee schedule is as follows:

1.00% per year for the first $3M

0.80% per year for the next $7M

0.65% per year for the next $15M

0.50% per year for the next $25M

0.35% per year for amounts over $50M

Join our Community

Sign up for our mailing list and get ready for exciting updates delivered straight to you!